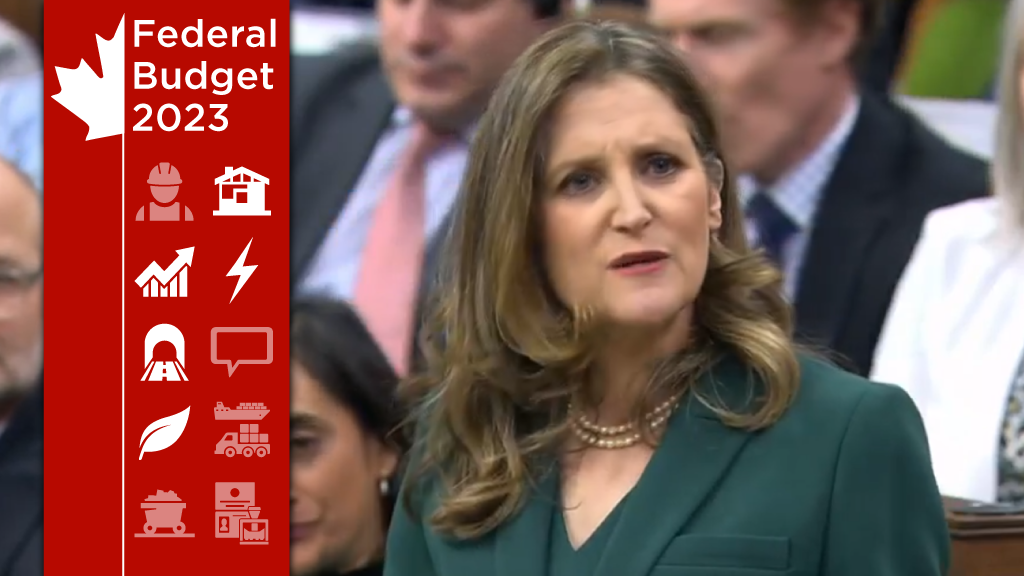

Canadian Finance Minister Chrystia Freeland has unveiled a federal budget with a sharp new focus on expanding and transforming Canada’s electricity system, a shift in the role of the Canada Infrastructure Bank and deficits for the foreseeable future.

Freeland delivered Budget 2023 in the House of Commons on March 28. The title, A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future, referred in part to the Liberal government’s intention to spend heavily to revamp Canada’s energy sector so that it can compete with green energy initiatives the Joe Biden administration is undertaking in the United States.

“Canada has free trade deals with countries that represent two-thirds of global economy,” stated Freeland. “We are going to make Canada a reliable supplier of clean energy to the world, and, from critical minerals to electric vehicles, we are going to ensure that Canadian workers mine, and process, and build, and sell the goods and the resources that our allies need.”

The budget document quotes analysis from the Bank of Canada and the Office of the Superintendent of Financial Institutions suggesting that “decisive action” is required to ensure Canada remains competitive during the global shift to net-zero.

“The recent passage of United States’ Inflation Reduction Act poses a major challenge to our ability to compete in the industries that will drive Canada’s clean economy,” the budget states.

In response, the government will spend $83 billion, the expected cost of tax credits for clean energy and electricity, through to the 2034-35 fiscal year.

The major new programs include the Clean Electricity Investment Tax Credit and the Clean Technology Manufacturing Investment Tax Credit. A Clean Hydrogen Investment Tax Credit was introduced in the 2022 Fall Economic Statement.

The investment tax credit is expected to cost $4.5 billion over five years, starting in 2023-24, and an additional $6.6 billion from 2028-29 to 2034-35. The credit would apply to property that is acquired and becomes available for use on or after Jan. 1, 2024, and would no longer be in effect after 2034, subject to a phase-out starting in 2032, the budget stated.

The government will also enhance the Carbon Capture, Utilization, and Storage Investment Tax Credit and expand eligibility for the Clean Technology Investment Tax Credit.

The Canada Infrastructure Bank, meanwhile, will see its mandate revised to “play a leading role in electrifying Canada’s economy.” The CIB will invest “at least $10 billion through its Clean Power priority area, and at least $10 billion through its Green Infrastructure priority area” in order the support major clean electricity and other “clean growth” infrastructure projects, the budget stated.

Freeland said the plan would boost jobs for auto workers who build electric vehicles, for skilled tradespeople expanding Canada’s clean energy grid and building affordable, energy-efficient homes, and for miners and energy workers “powering Canada and the world.”

The government has allocated billions to building retrofit programs as another green initiative in previous budgets but there was one notable tweak to the government’s National Housing Co-Investment Fund announced in Budget 2023; Freeland announced the reallocation of funding from the fund’s repair stream to its new construction stream, to boost the construction of new affordable homes.

The budget noted that economists expect the Canadian economy to enter a shallow recession in 2023, with a peak-to-trough decline of 0.4 per cent. That is less severe than the 1.6 per cent decline considered in the 2022 Fall Economic Statement downside scenario.

On an annual basis, real GDP growth is projected to decelerate from 3.4 per cent in 2022 to 0.3 per cent in 2023, before rebounding to 1.5 per cent in 2024.

Inflation is expected to fall below three per cent in the third quarter of 2023 and to reach about two per cent, the Bank of Canada’s target, in the second quarter of 2024.

Starting in the 2022-23 fiscal year, the government’s deficits will be in a narrow range: $42.4 billion, $43.5 billion, $43.2 billion, $42.2 billion and $41.1 billion in 2026-27.