Surprised by the high cost of homes in Canada? If so, you’re not alone.

The cost of homes decreased throughout Canada in late-2022 compared to the previous year. However, the cost of buying a home in Canada has risen dramatically over the past decade, making homeownership more difficult, especially for the younger generation.

Some of the main factors contributing to the high cost of homes in Canada include an increased demand for homes, inflation, urbanization, and the rising cost of building materials.

Below, I’ll give you an overview of the current housing market and outline why are houses so expensive in Canada.

House Prices Have Increased Dramatically Over The Past Decade

Canada has become “a nation of renters,” according to the latest report by RBC’s Thought Leadership group. Despite the fact that around two-thirds of Canadians own their home, the report states that the number of renters has increased by three times the rate of homeowners since 2011.

There are a number of factors that have contributed to this. However, the high cost of buying a home today is undoubtedly one of the top reasons that hold many would-be homeowners back from pulling the trigger and applying for a home loan.

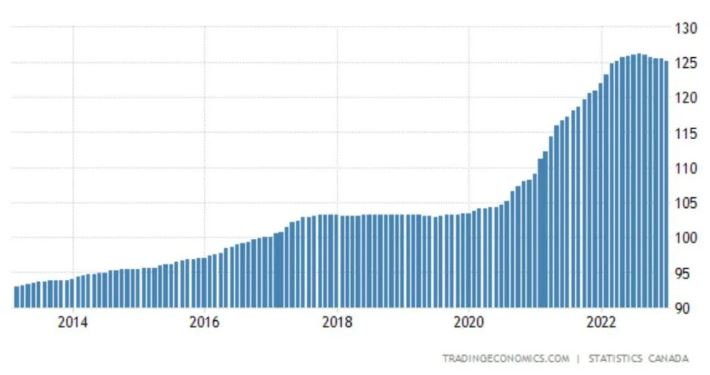

To give you an idea of just how much home prices have increased, here’s a table compiled by Trading Economics using data from Statistics Canada:

The numbers on the x-axis represent the housing price index, which measures the movement of single-family house prices.

A housing price index of 100 represents stability. Numbers under 100 indicate that housing prices are lower than average, while numbers over 100 indicate that homes are more expensive than average.

The housing price index in Canada for January 2023 was 128.9, according to Statistics Canada.

Reasons Why Houses Have Become More Expensive

Above, I touched on some factors contributing to rising home prices in Canada. Now, I’ll give you a deeper overview of why houses have become so expensive in Canada.

Increased Demand For Homes

The age-old law of supply and demand is just as applicable to the real estate market as it is to consumer goods. One of the primary factors driving up home costs in Canada is the simple fact that there is a housing shortage in Canada.

This means that more people are searching for homes than there are available homes on the market. This creates a sellers’ market, encouraging homeowners and real estate investment firms to sell properties for higher than usual. While this is good news for homeowners, it’s not great for prospective home buyers.

A June 2022 report by the Canada Mortgage and Housing Corporation (CMHC) stated that an additional 3.5 million affordable housing units would need to be constructed by 2030 to stabilize housing prices.

In 2004, the average household only needed to devote 40% of their disposable income to purchase a home in Ontario. In 2021, the same household would need to devote almost 60% of their disposable income to buy a home, according to the same report by the CMHC.

Some of the main factors that contribute to increased demand for housing in Canada include:

- Record numbers of immigrants coming into Canada

- Steady population growth

- Lack of affordable homes on the market

- Investors purchasing homes to protect their money

Inflation

Inflation has been a big topic over the past couple of years. You’ve undoubtedly noticed the steady price increases of everyday necessities and groceries. However, inflation can also affect the housing market.

As the buying power of the Canadian dollar decreases, prospective homebuyers will need more money to buy a home.

Unfortunately, income levels aren’t exactly rising to meet the current inflation levels. Canadians who may have been able to afford a home five years ago may not earn enough today to cover the cost of buying a new home.

Rising Material Costs

During the pandemic, many countries closed their borders to trade, and overseas facilities ramped down their production of building materials. This caused massive delays for builders and general contractors nationwide and dramatically increased the cost of building materials (supply and demand).

- Record numbers of immigrants coming into Canada

- Steady population growth

- Lack of affordable homes on the market

- Investors purchasing homes to protect their money

Inflation

Inflation has been a big topic over the past couple of years. You’ve undoubtedly noticed the steady price increases of everyday necessities and groceries. However, inflation can also affect the housing market.

As the buying power of the Canadian dollar decreases, prospective homebuyers will need more money to buy a home.

Unfortunately, income levels aren’t exactly rising to meet the current inflation levels. Canadians who may have been able to afford a home five years ago may not earn enough today to cover the cost of buying a new home.

Rising Material Costs

During the pandemic, many countries closed their borders to trade, and overseas facilities ramped down their production of building materials. This caused massive delays for builders and general contractors nationwide and dramatically increased the cost of building materials (supply and demand).

The cost of lumber and plywood isn’t the only problem, though.

The cost of energy has also increased. It requires massive amounts of fuel to transport building materials from overseas to the Canadian mainland. Once they arrive at a port in Canada, they must then be shipped across the country using diesel-fuel-powered trucks or trains.

When you combine higher material costs with higher transportation costs, it drives the cost of new construction up significantly.

Real Estate Investment

In times of economic change, investors often try to protect their wealth by investing in assets that hold their value (or increase in value). Real estate is one of the most popular assets purchased by wealthy investors.

Unfortunately, this can create a housing shortage by removing homes from the market that could otherwise be purchased by prospective homeowners.

These homes then turn into rental properties, which decreases the supply of available homes (increasing prices) and pressures people into renting a home rather than buying.

Often, top real estate investors wait until poor economic conditions to swoop in and buy cheap housing so that they can hold onto it and sell it for a higher price once conditions improve.

While this can be a solid investing strategy, it can adversely affect the average Canadian.

To combat this, the Canadian government recently passed an act prohibiting non-Canadians from purchasing residential properties. This act effectively prevents foreign investors from contributing to Canada’s housing shortage and aims to make homeownership more affordable for Canadians.

This act is called the Prohibition on the Purchase of Residential Property by Non-Canadians Act and was enacted on January 1st, 2023.

Urbanization Trends

Urbanization describes the pattern of a country’s inhabitants moving from less populated rural areas into more populated urban areas. Urbanization is often driven by individuals seeking to find higher-paying employment and improved opportunities in urban regions.

Over the past few years, the urbanization rate in Canada has increased by 10% year-over-year, according to a report from Globaldata.com.

The unfortunate consequence of urbanization is that it drives up rental rates and the cost of homes in urban regions, making it more expensive for everybody.

If you look at recent changes in housing prices, you’ll notice that urban centres like Toronto and Vancouver saw more dramatic home price increases than surrounding rural towns.

Forecasted Home Market For 2023

Wondering what to expect for 2023?

Home prices are beginning to stabilize in 2023, compared to the rapid increase in the housing price index after the pandemic.

Although inflation levels are still high, they have fallen incrementally. We can expect to see relatively stable housing marketing in 2023, according to a recent report from Realtor.ca.

In the report, senior economist at the Canadian Real Estate Association (CREA), Shaun Cathcart, stated, “I don’t think they’re going to turn a corner and go skyrocketing back into the stratosphere the way they were a couple of years ago. I think we’ll be in a bit of a holding pattern.”

4 Tips To Help You Save For A House

Although the housing market may be overpriced, home prices are forecasted to remain stable for the remainder of the year. The federal interest rate is still high (to combat inflation) but is expected to decrease moving into late-2023 and early-2024.

Even though you might not be able to afford a home now, it’s a good time to start planning and saving for the future. Here are a few tips to help you save for your first house:

- Open A First Home Savings Account (FHSA): The FHSA allows you to save up to $40,000 towards a home down payment. Contributions are tax-deductible, growth is tax-free, and withdrawals are tax-free. This program will become available nationwide in April 2023.

- Live Below Your Means To Save: Cut out unnecessary spending and divert the extra money saved into your FHSA or other tax-advantaged savings programs. In the long run, it pays to remain humble and live below your means in the short term. If you can save $100 per week by not eating out or going to the bar/club, you’ll have an extra $5,200 by the end of the year.

- Consider A CMHC-Backed Loan: If you’re approved for a CMHC-backed loan, you only need to make a 5% down payment on your first home. This can make it easier for Canadian residents to purchase their first home. The only caveat is that you’ll need to purchase additional mortgage insurance, which can increase your mortgage payments.

- Start A Side Hustle To Save More: In addition to budgeting and cutting extra spending, you should consider increasing your revenue. Ask for a raise at your job, pick up a weekend gig, drive for Uber/Lyft, or start freelancing on the side.

Conclusion – Houses Can Be A Costly Investment

Buying a house can be a costly investment, especially given the current real estate market. However, if you’re serious about owning a home in the future, you should start preparing now. The more you can budget, save, and increase your income, the quicker you’ll be able to afford your home.